Priority Savings

Position

Lloyds wanted to focus their efforts on acquiring the Mass Affluent demographic, i.e. customers who have disposable income but require guidance on the best ways to save for their plans

Problems

Existing and potential customers were apprehensive about saving money long-term, not feeling confident about which option to choose

Possibilities

Design a simple/guided flow that will improve conversion

Design process

Discovery

Customers ranged between 30 and 50 years of age. High-income demographic, with minimal long-term goal saving experience

Insight

Most people were either unaware of what was possible/available to them or were experiencing a type of decision paralysis. Most people interviewed felt uninformed and not in control of their financial futures.

Exploration

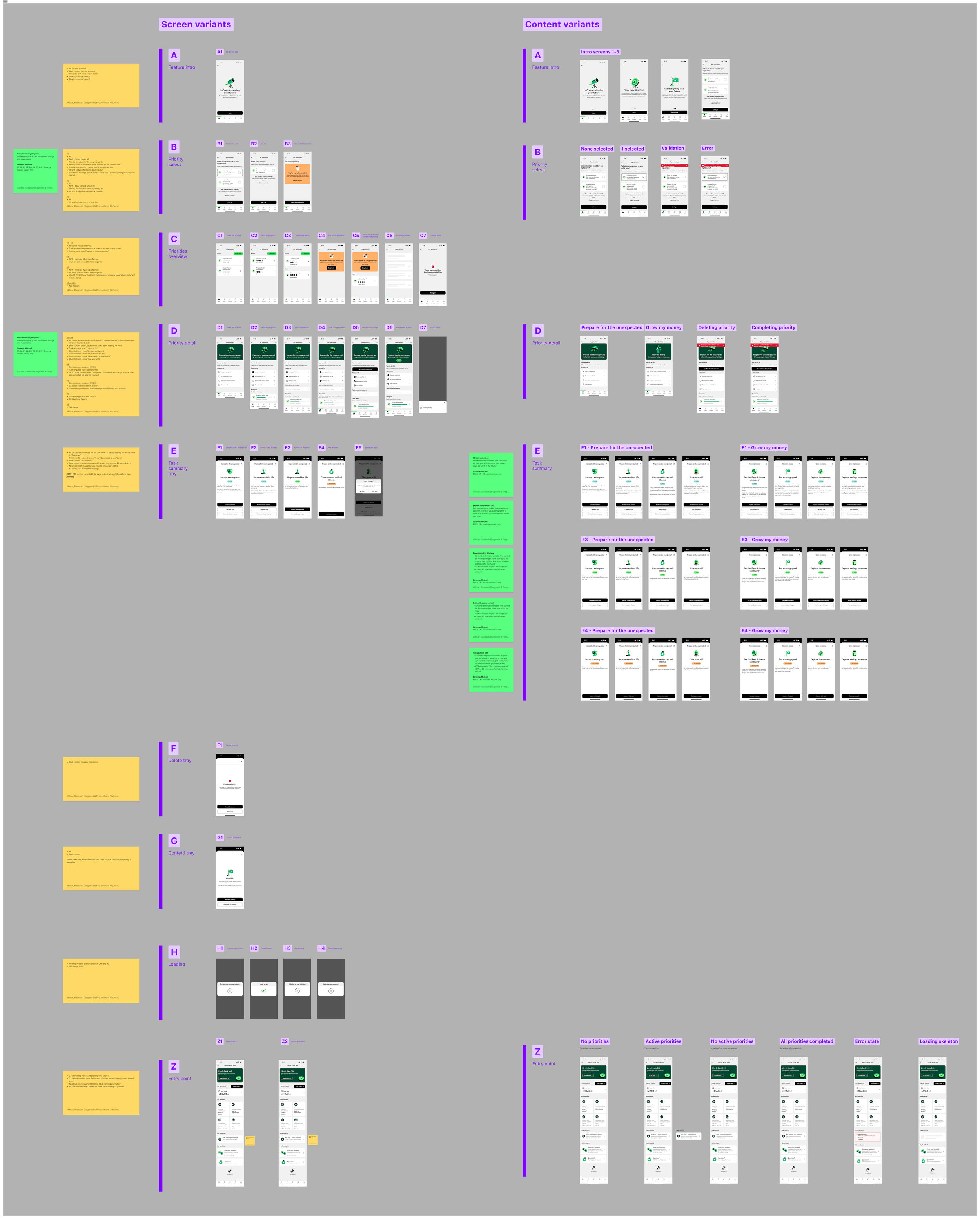

We explored the possibility of giving two simple options to choose from to negate choice paralysis. Grow your money or be prepared for whatever life brings you. From thereon, each option had four tasks that had to be completed to ensure the maximum chances of success.

Design. Grow your money / “Prepare for the unexpected” flow

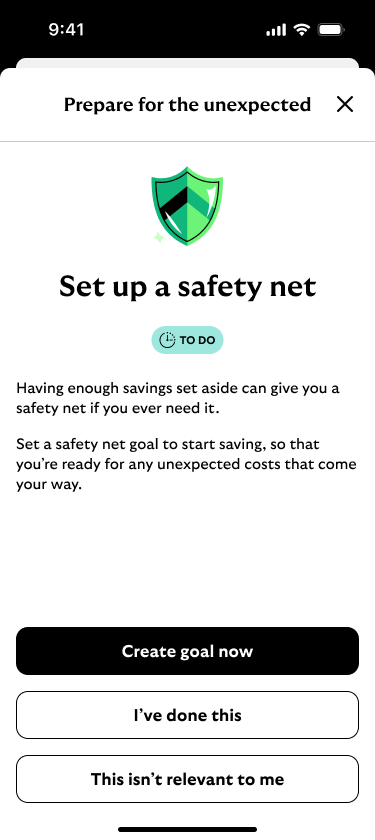

Step 1.

Flow begins here

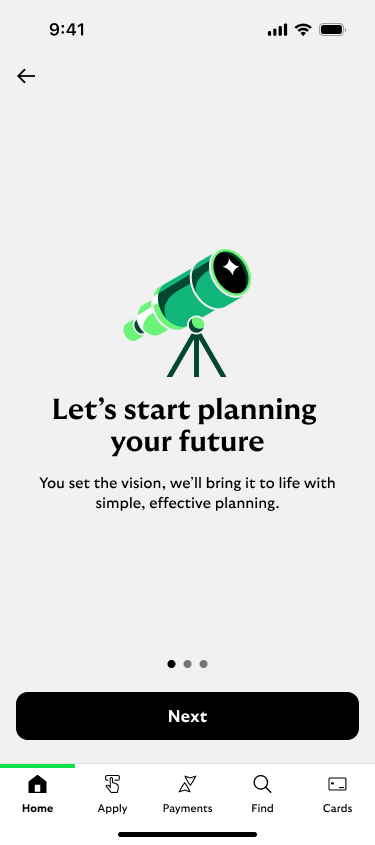

Full user flow (no priorities selected)

Pros More choices to explore / Visceral / Low cognitive load / Fast completion rate

Cons: More depth was asked for, even though the flow journey was simple, some people were reluctant making immediate decisions

Screen and content variants

Conclusion + Results

4-out-of-5 testers said they found the new flow easy to understand and would happily complete the journey. However, half of our testers said they wanted some explanatory copy before making a choice. In round two of this project, we planned and began building out tooltips and other methods for providing just enough information.

When this product went live, 4.5k customers joined in the first month.

Step 5.

Once all 4 tasks are done, this is the final “activation” step

Step 2.

Onboarding sets the scene, takes the thinking/deciding process out of a traditional Savings flow

Step 3.

Let’s keep it simple. The two most popular goals people wanted to save for were long-term and short-term.

Action: Selection made

Step 4.

User must complete 4 tasks to fully activate their goal